Scottsdale, AZ Home Insurance

Call (480) 657-2800 for Home Insurance in Scottsdale, AZ

Shopping for Home Insurance in Scottsdale?

Your home in Scottsdale may be the single largest investment you ever make. It makes sense to protect your home with the best Scottsdale Homeowners Insurance. To find the right home insurance at the best prices, you can trust the insurance professionals at Greene Insurance Group. Our Licensed Insurance Agent will assist you with understanding your home insurance. We go to work to comparing home insurance coverage and rates from top-rated insurance companies. You can trust the Insurance Professionals at Greene Insurance Group to save you time and money!

What to know about Scottsdale Homeowners Insurance

Insuring your home in Scottsdale can help protect you financially if you suffer a loss due to fire, theft, vandalism, or other covered events. Homeowners Insurance can also provide protection in the event someone is injured while on your property and wins a legal judgment against you. We provide the options and you select the home insurance policy that’s right for you and your family.

How much you pay for your policy depends on these items:

- What you select – Home Insurance often has endorsements or options that are priced individually, so how much you’ll pay for your policy depends on what coverages you purchase.

- How much you want to cover- If select a higher insurance deductible, you will lower your premium price by shifting part of the loss payment to you. For example, if you had a $1,000 deductible, you would be responsible for paying the first $1,000 of the a covered loss.

- Where you set your limits- You may choose to set higher limits than the recommended amount if appropriate to your situation and needs. We’ll help you understand the coverage.

- Personal Umbrella protects your assets– Personal umbrella insurance extends your liability coverage and protects your assets such as your home, autos, boats, motorcycles, rental properties, etc.

The Right Protection. The Right Price. The Right Value

The amount you pay for your Arizona homeowners insurance depends on many factors. Think of your personal housing situation, and the assets you want to protect.

Bundle Your Scottsdale Home Insurance with Auto Insurance to Save More!

When bundle your Scottsdale Home Insurance and Scottsdale Auto Insurance together, you may be able to save up to 40% on your package.

Scottsdale Home Insurance Coverage:

Dwelling Coverage: Property Insurance or Homeowners Insurance typically pays to repair or rebuild your Scottsdale home if it’s damaged or destroyed by an insured event like a fire or storm.

Personal Liability Protection: Personal Liability Insurance applies if someone is injured or their property is damaged and you are to blame. When choosing your liability coverage limits, consider your annual earnings or wages and the assets you own. Your personal liability coverage should be high enough to protect your assets or prevent garnishment of future wages if you are sued.

Medical Payments: Medical Payments insurance covers medical expenses for guests if they are injured at your Scottsdale home, and in certain cases covers people who are injured off of your property. It does not cover health care costs for you or other members of your household.

Additional Living Expenses: If you can’t live in your home because of a covered loss, your Scottsdale homeowners insurance policy will pay additional living expenses-commonly up to a period of time (usually 12-24 months), while damage is assessed and your home is repaired or rebuilt.

Protection for Your Personal Property: Your home is filled with furniture, clothes, electronics and other items that mean a lot to you. Personal Property Insurance helps replace these items if they are lost, stolen or destroyed as a result of a covered loss.

Scheduled Personal Property: If you have special possessions such as jewelry, art, antiques or collectibles you may want to talk to your agent about this additional coverage. SPP provides broader coverage for specific items.

If You Plan to Rent Your Home: If you plan to rent your Scottsdale Home or Property, you will need a landlord or short term-rental insurance policy. Visit our Landlord Insurance page for more information.

Scottsdale Homeowners – Protect the Things that Matter to You

We encourage our clients to make an inventory of your home and personal belongings.

- Take an inventory and save to a spreadsheet and save the files to a cloud drive or email in case a total loss such as a fire were to occur and you lost your computer and information.

- Take photos or videos of your home and possessions and save to a backed up cloud drive or email such as gmail.

- Using two methods such as taking photos and videos of your personal possessions can help expedite the claim resolution process.

Call the Insurance Professionals of Greene Insurance at 480-657-2800 for Scottsdale, Arizona Homeowners Insurance Quotes. We look forward to discussing your insurance needs. Thank you!

Greene Insurance Group – Scottsdale Insurance Agency

Providing Best in Class Service

Since 1962, our family has pledged to protect families and businesses through personal insurance and business insurance products. As an Independent Insurance Agency in Scottsdale, Greene Insurance Group will review your current insurance coverage and help you compare insurance rates from dozens of top-rated insurance companies. Greene Insurance Group will be your Scottsdale Insurance Agent and we’ll be here to make any changes to your policy, answer questions regarding your insurance coverage or potential claims. You can trust our team of professionals for best in class service.

Scottsdale, AZ Independent Insurance Agent

Greene Insurance Group is an locally-owned Scottsdale Independent Insurance Agent offering personal insurance and business insurance from top-rated insurance companies. Unlike many other insurance agencies in Scottsdale and Arizona, Greene Insurance Group isn’t owned by an insurance company and we offer insurance from dozens of top-rated insurance companies. We’re a locally-owned Scottsdale Independent Insurance Agency allowing us to customize insurance coverage to save our clients time and money.

Greene Insurance Group offers Personal Insurance such as: Car Insurance, Home Insurance, Renters Insurance, Condo Insurance, Landlord Insurance, RV Insurance, Motorcycle Insurance, Motorhome Insurance, Boat Insurance and more.

Greene Insurance Group offers Business Insurance such as: Business Liability Insurance, Commercial Property Insurance, Workers Compensation Insurance, Business Auto Insurance, Inland Marine Insurance, Professional Liability Insurance, Commercial Umbrella Insurance and more.

Insurance from Top-Rated Insurance Companies:

Some of the insurance companies we represent in Arizona include: Auto-Owners, Chubb, Cincinnati, Foremost-Farmers, The Hartford, Liberty Mutual, Main Street-American Family, Mercury, National General-Allstate, Nationwide, Progressive, Safeco-Liberty Mutual, Travelers, West Bend and many more specialty insurance companies.

Some may assume purchasing insurance online or direct from an insurance company offers more savings. We have found this isn’t the case. Clients who compare our insurance quotes, coverage, discounts and features versus those of our competitors, find the insurance quotes and service we provide rival our competitors.

Trusted Choice Insurance Agency in Arizona

Some final considerations when purchasing insurance:

- Once you purchase insurance, Who will be your point of contact when a question arises or you need to make a change to your insurance coverage?

- When you reach out to your Insurance Company, what will your experience be? Will you experience long hold times when you call? At Greene Insurance, we answer our calls promptly.

- Insurance rates change from time to time and your needs may change if you move, trade vehicles or have a claim. Does your insurance company or insurance agent offer insurance from other insurance companies? Greene Insurance Group offers personal and business insurance from dozens of top-rated insurance companies. We save our clients the hassles of shopping for insurance saving you time and money.

- Some insurance agents or companies require their customers submit a contact request and wait for an email response. It’s our pledge you will always be our top priority and our licensed insurance agents will answer your call, return messages and respond in a timely fashion.

- You can trust Greene Insurance Group. We save our clients time & money. You can relax knowing when you select Greene Insurance Group, we’re working in your interest to help you understand your insurance and coverage and customize it to fit your unique needs.

When you select Greene Insurance Group, we’ll be your local Arizona Insurance Agent. Our team prides itself with providing best in class service.

Looking for Scottsdale Public Utility Information?

Client Testimonials & Reviews

Scottsdale, Arizona Insurance: What You Need to Know

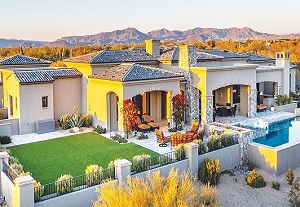

Scottsdale, Arizona is a beautiful and affluent city with a population of over 250,000 people. It is known for its luxury homes, world-class golf courses, and stunning desert scenery.

If you live in Scottsdale, it is important to have the right insurance coverage to protect yourself and your loved ones from financial hardship in the event of an unexpected event. Here are some of the most important types of insurance for Scottsdale residents:

- Home insurance: Home insurance can protect your home and belongings from damage or loss due to a variety of events, including fire, windstorm, hail, lightning, theft, vandalism, and water damage.

- Auto insurance: Auto insurance is required by law in Arizona. It provides financial protection in the event of an accident, regardless of who is at fault.

- Renters insurance: Renters insurance is not required by law, but it is a good idea for renters to have. It can protect your belongings from damage or loss due to a variety of events, including fire, theft, and vandalism.

- Business insurance: Business insurance can protect your business from financial losses due to a variety of events, including lawsuits, property damage, and business interruption.

- Life insurance: Life insurance can provide financial support to your loved ones in the event of your death.

In addition to these basic types of insurance, Scottsdale residents may also want to consider purchasing the following types of insurance:

- Flood insurance: Flood insurance is not covered by most homeowners insurance policies. If you live in an area that is prone to flooding, you may want to purchase flood insurance.

- Earthquake insurance: Earthquake insurance is also not covered by most homeowners insurance policies. If you live in an area that is prone to earthquakes, you may want to purchase earthquake insurance.

- Umbrella insurance: Umbrella insurance provides additional liability protection beyond what is provided by your other insurance policies. It can be helpful in the event of a major lawsuit.

Here are some tips for saving on insurance in Scottsdale, Arizona:

- Call an Independent Insurance Agent like Greene Insurance. We save you time and money by finding the best coverage at the best rates from top-rated insurance companies.

- Raise your deductible. A higher deductible will lower your monthly premium, but you will have to pay more out of pocket if you file a claim.

- Bundle your insurance policies. If you have multiple insurance policies, such as home and auto insurance, you may be able to save money by bundling them together.

- Take advantage of discounts. Many insurance companies offer discounts for things like having a good credit history, taking a safe driving course, or installing security features in your home.

By having the right insurance coverage, you can protect yourself and your loved ones from financial hardship in the event of an unexpected event.

Additional tips for Scottsdale residents

Scottsdale is located in the Sonoran Desert, which means that it is prone to extreme weather events such as heat waves, dust storms, and wildfires. When choosing insurance coverage, it is important to consider the risks that are specific to your area.

For example, if you live in an area that is prone to wildfires, you may want to purchase additional coverage for your home and belongings. You may also want to consider purchasing umbrella insurance to provide additional liability protection in the event of a wildfire.

It is also important to review your insurance coverage on a regular basis to make sure that it meets your needs. As your life changes, your insurance needs may change as well. For example, if you get married, have children, or purchase a new home, you may need to update your insurance coverage.

By following these tips, you can ensure that you and your loved ones have the right insurance coverage to protect you from financial hardship in the event of an unexpected event.